Fraud: year ending December 2017

Attempted fraud and fraud offences involving a loss in England and Wales. Including cyber crime, computer misuse, false accounting, and banking fraud.

Release date: 26 April 2018

Next release: 19 July 2018 (provisional)

This page is part of the latest collection | View all pages in this collection or view previous collections

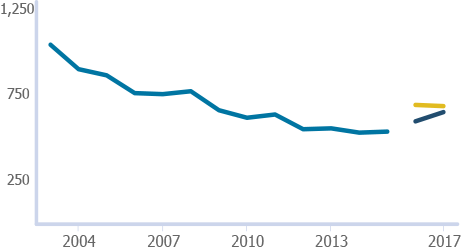

No change in fraud offences in the last year, following four years of rises

England and Wales, year ending March 2012 to year ending December 2017

Source: Action Fraud, National Fraud Intelligence Bureau (NFIB)

- Over half (1.8 million) of fraud incidents were cyber-related

- Less than one-fifth of fraud incidents are reported

On this page:

- Analysis of fraud

- Fraud data

- How do we measure this?

- What do you need to know?

- Glossary

- More pages in this collection

- More about fraud

- Contact us

Pages in this collection:

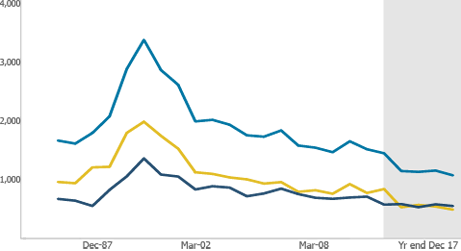

All main sources of fraud data suggest no increase

3.2 million fraud offences were measured by the Crime Survey for England and Wales (CSEW). This has not increased from the results of last year’s survey.

The Crime Survey for England and Wales (CSEW) provides the best indication of the volume of fraud offences directly experienced by individuals in England and Wales. CSEW estimates cover a wide range of fraud offences, including attempts and offences involving a loss, and include incidents not reported to the authorities.

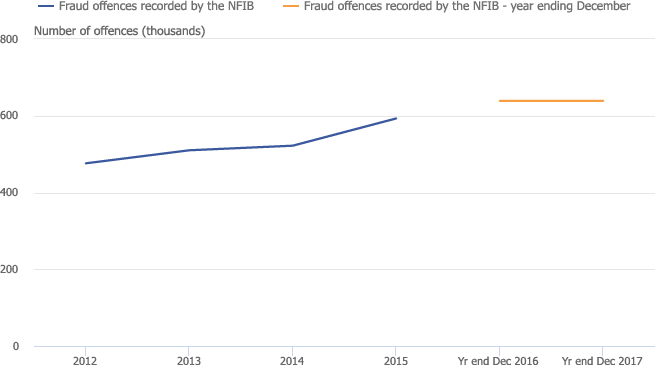

Recorded crime showed a similar volume of fraud offences in the year ending December 2017 (639,457 offences) compared with the previous year (639,476 offences).

This separate source of fraud data incorporates fraud offences collated by the National Fraud Intelligence Bureau (NFIB) from Action Fraud, Cifas and UK Finance and referred to the police for investigation.

The number of incidents estimated by the CSEW is substantially higher than the number of incidents referred to the NFIB, as the survey captures a large volume of lower-harm cases that are less likely to have been reported to the authorities.

Small fall in banking and credit industry fraud, cheque, card and online bank account fraud

Although there was no overall change, differences were shown in the number of offences recorded in the last year.

Overall offences showed:

- Cifas fell by 7% (down to 283,284 offences)

- UK Finance fell by 6% (down to 82,575 offences)

The falls reported by both Cifas and UK Finance were due largely to a decrease in the volume of “banking and credit industry fraud".

This latest decrease reported by Cifas follows a period of increases seen in this type of fraud, and is driven largely by a decrease in “cheque, plastic card and online bank accounts fraud” (down 5% to 169,504 offences).

Cifas also reported a 3% decrease in “application fraud” referred to NFIB. This includes opening up an account using fake or stolen documents in someone else’s name.

Again, this latest decrease in application fraud reported by Cifas follows previous large rises and is thought to reflect a return to normal levels after a spike in reporting in September 2016, as well as banks taking more preventative measures.

There was a 10% increase in offences reported to Action Fraud. These were driven by increases in “advance fee payment fraud" (up 32% to 52,469 offences) and “consumer and retail fraud” (up 4% to 105,921 offences).

Rate of fraud in Southern England slightly higher than in Wales or northern England

The latest police force area data show there was generally less variation in rates of fraud by police force area than for most other types of crime, although rates for force areas in southern England were generally a little higher than those among force areas in Wales or northern England.

Drop in offences such as investment fraud or charity fraud

The only category of fraud to show a significant change was “other fraud” (down 64%, from 97,000 to 35,000 offences).

Table 6: Crime Survey for England and Wales fraud - number of incidents for year ending December 2016 and year ending December 2017 with percentage change

| England and Wales | Adults aged 16 and over | |||

| Offence group | Jan '16 to Dec '16 | Jan '17to Dec '17 | Percentage change and significance | |

|---|---|---|---|---|

| Number of incidents (thousands) | ||||

| Fraud | 3,480 | 3,241 | -7 | |

| Bank and credit account fraud | 2,454 | 2,332 | -5 | |

| Consumer and retail fraud | 827 | 813 | -2 | |

| Advance fee fraud | 102 | 61 | -41 | |

| Other fraud | 97 | 35 | -64 | * |

| Unweighted base - number of adults | 17,500 | 20,974 | ||

Source: Crime Survey for England and Wales, Office for National Statistics

Notes:

- Statistically significant change at the 5% level is indicated by an asterisk.

- Non-investment fraud has been renamed as 'Consumer and retail fraud' to reflect the corresponding name change to the Home Office Counting Rules from April 2017.

Download this table

Fraud data

This page mainly reports on data from the Crime Survey for England and Wales (CSEW) and the National Fraud Intelligence Bureau (NFIB), which collates data from Action Fraud, Cifas and UK Finance.

More information on both these sources can be found in the User guide to crime statistics for England and Wales.

Using fraud data

More pages in this collection

Crime overview

Over the long-term, crime has fallen, but some crimes have risen slightly in the previous 12 months.

Released: 26 April 2018

Weapons crimes

Police recorded 7,130 (22%) more crimes involving weapons, with knife crime in cities rising most.

Released: 26 April 2018

More about fraud

-

Overview of fraud and computer misuse statistics

Summary of the various sources of data for fraud and computer misuse and what these tell us about victims, circumstances and long-term trends.

Contact us

Mark Bangs

crimestatistics@ons.gov.uk

+44 (0)2075 928689